Our benchmarks report will review common ad performance metrics for Google Ads across brands using Triple Whale to monitor and maximize their performance. This analysis includes over 10,000 brands and compares the period of October 2025 (10/01/2025-10/31/2025) with September 2025 (09/01/2025-09/30/2025).

READ MORE | A Guide to Ecommerce Metrics

Additionally, we’ll break down the vertical-specific trends with data from the following industries:

October 2025 data reveals a steady and balanced month for Google Ads performance. The ecosystem continues to show signs of health and stability — advertisers are spending more, reaching more users, and maintaining efficiency despite slight shifts in conversion dynamics.

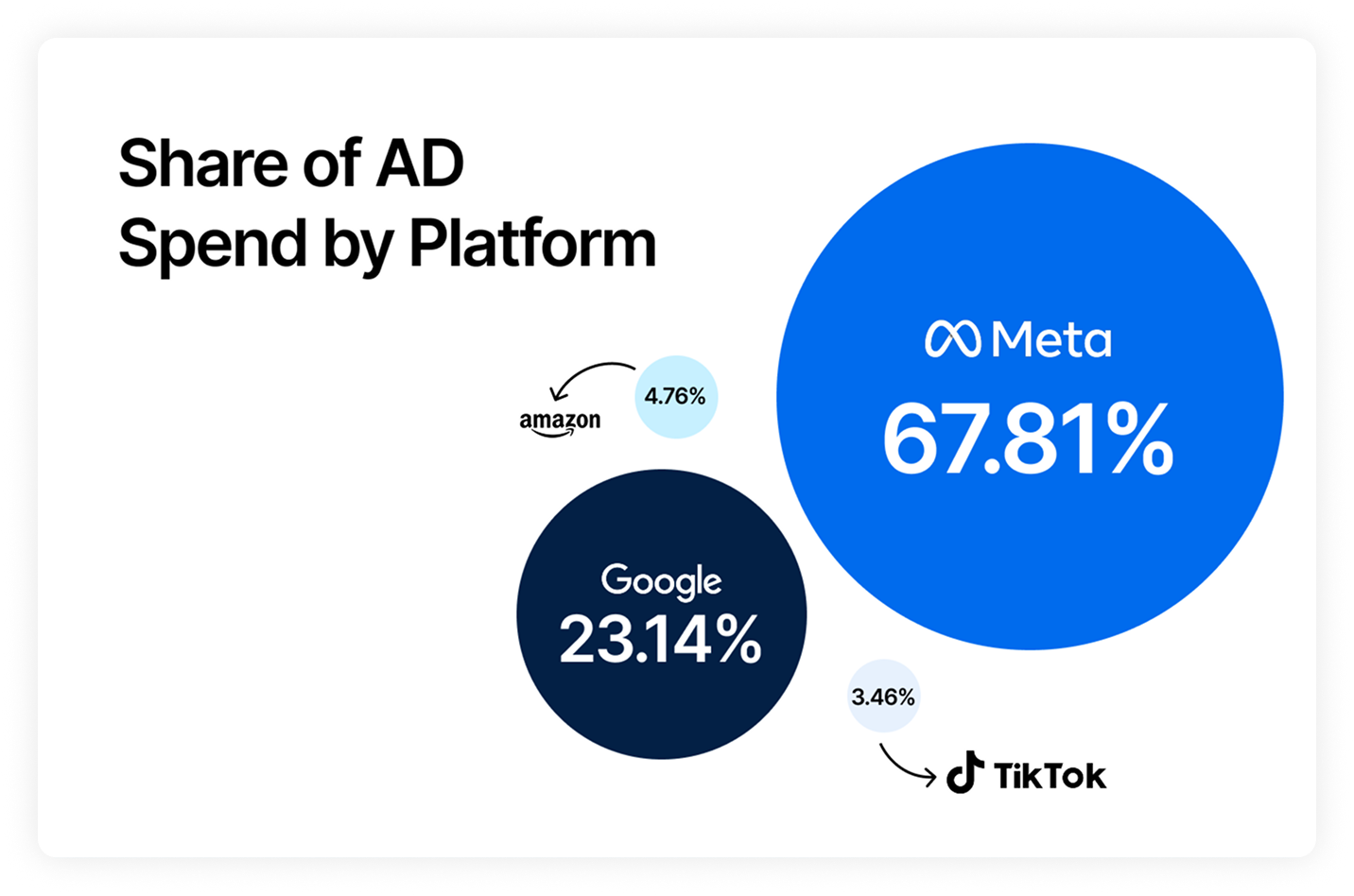

The slight overall lift in total ad share to 23.12% (+0.49%) points to a stable ecosystem where spending growth is matched by expanding reach and continued audience responsiveness.

Efficiency metrics painted a more nuanced story. The median CPA rose slightly to $30.34 (+1.94%), indicating marginally higher acquisition costs. However, this modest uptick was offset by stable performance elsewhere. The median CVR dipped 2.08% to 2.78%,

Median ROAS decreased 0.89% to 2.95. The median AOV increased 0.9% to $86.11, and the median MER held steady at 0.31.

Engagement trends remained encouraging: the median CTR climbed 3.7% to 1.56%, implying that ad relevance and targeting continued to improve even as CPMs rose slightly (+2.91%, $14.29).

October brought mixed results across industries. Some categories surged ahead with stronger engagement and higher order values, while others felt early Q4 competition tightened margins. Here’s where performance heated up and where brands may need to recalibrate.

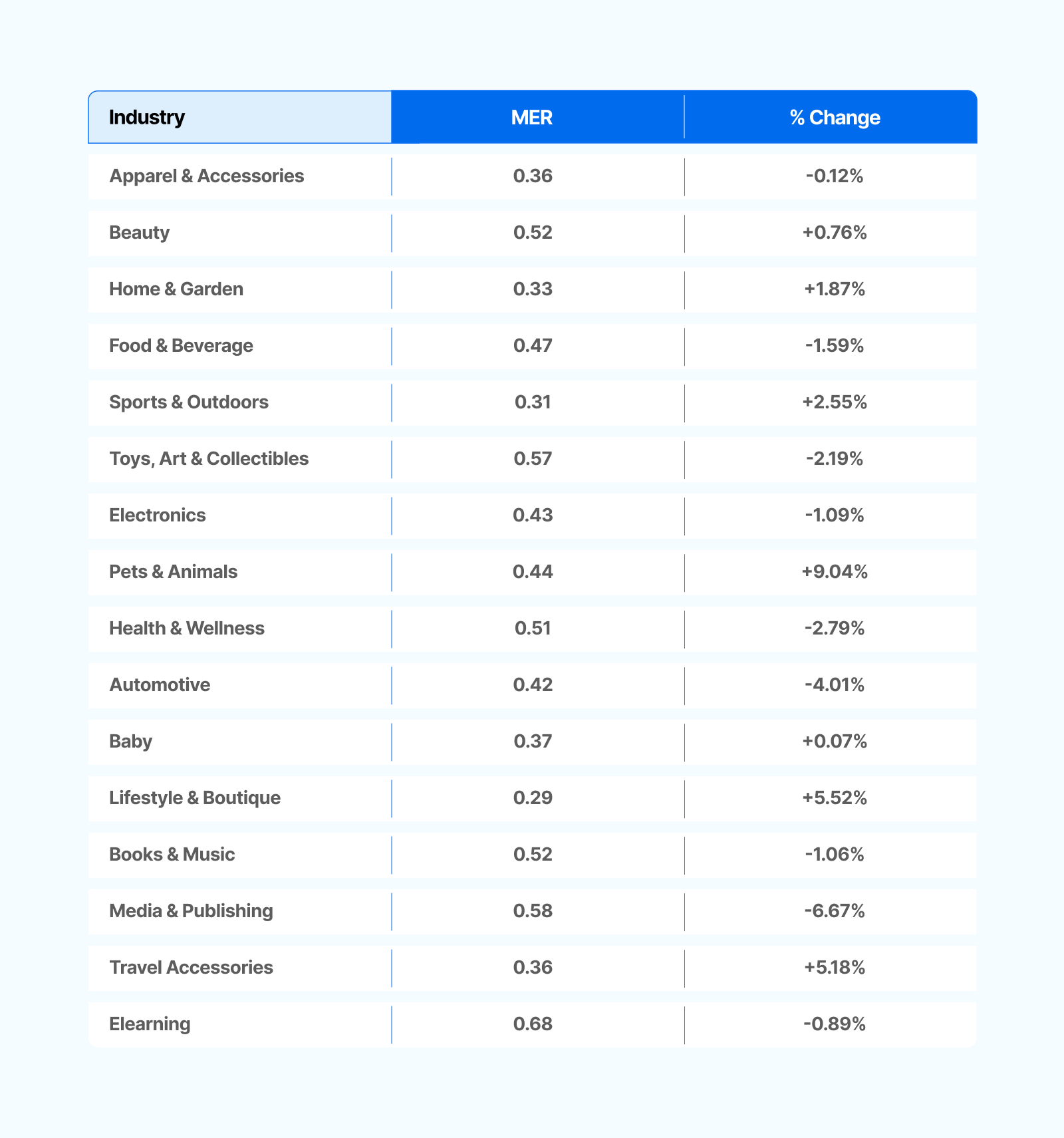

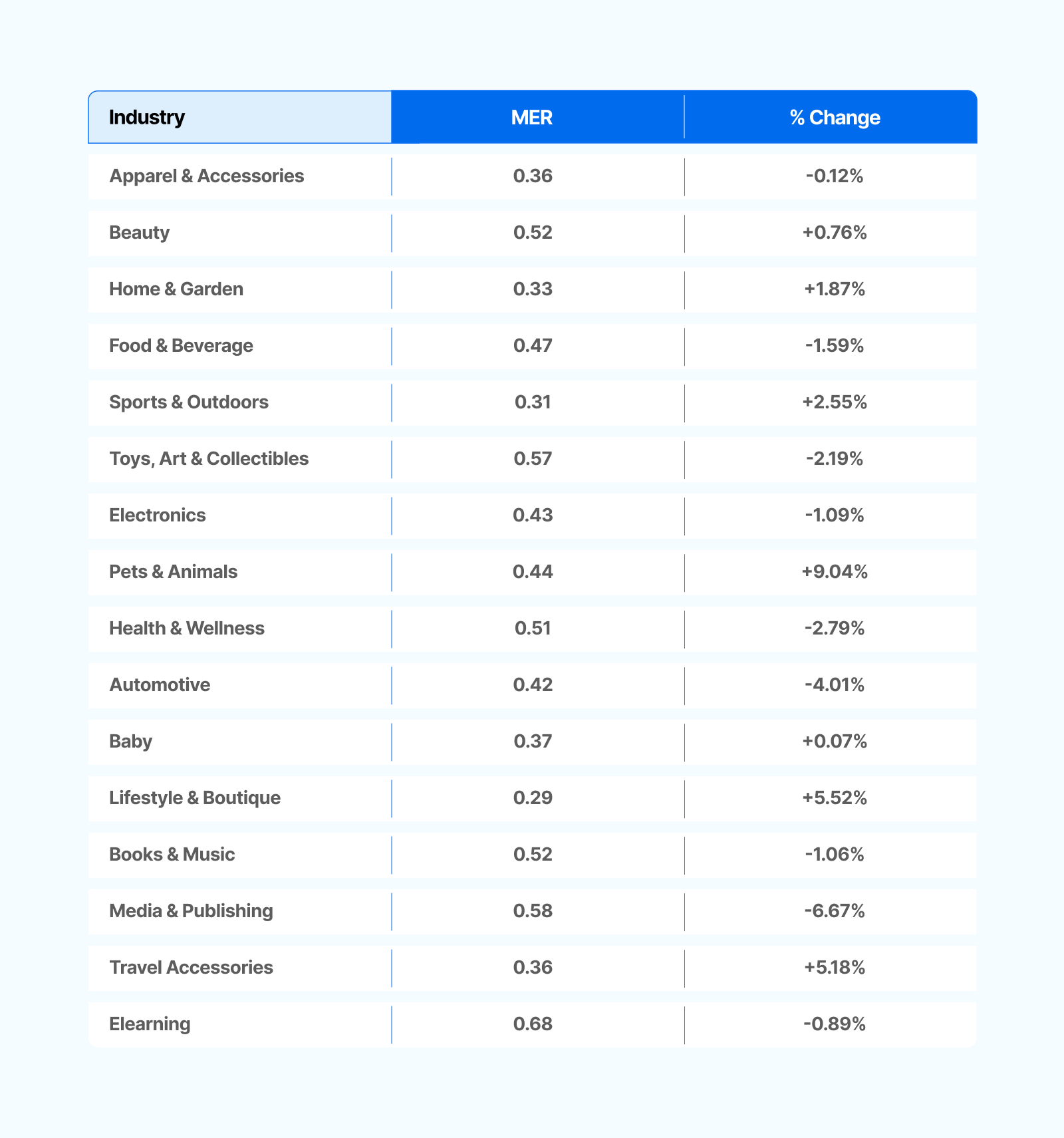

MER reflects how efficiently brands turn ad spend into revenue. This month, Pets & Animals led with a sharp +9.04% increase, reflecting improved profitability, likely driven by loyal repeat purchasers and rising average order values.

Lifestyle & Boutique and Travel Accessories also saw solid gains (+5.52% and +5.18%, respectively), signaling strength in discretionary spending as consumers prepared for holiday travel and gifting.

On the downside, Media & Publishing (-6.67%) and Automotive (-4.01%) faced steeper drops, suggesting less conversion traction amid rising competition and ad costs.

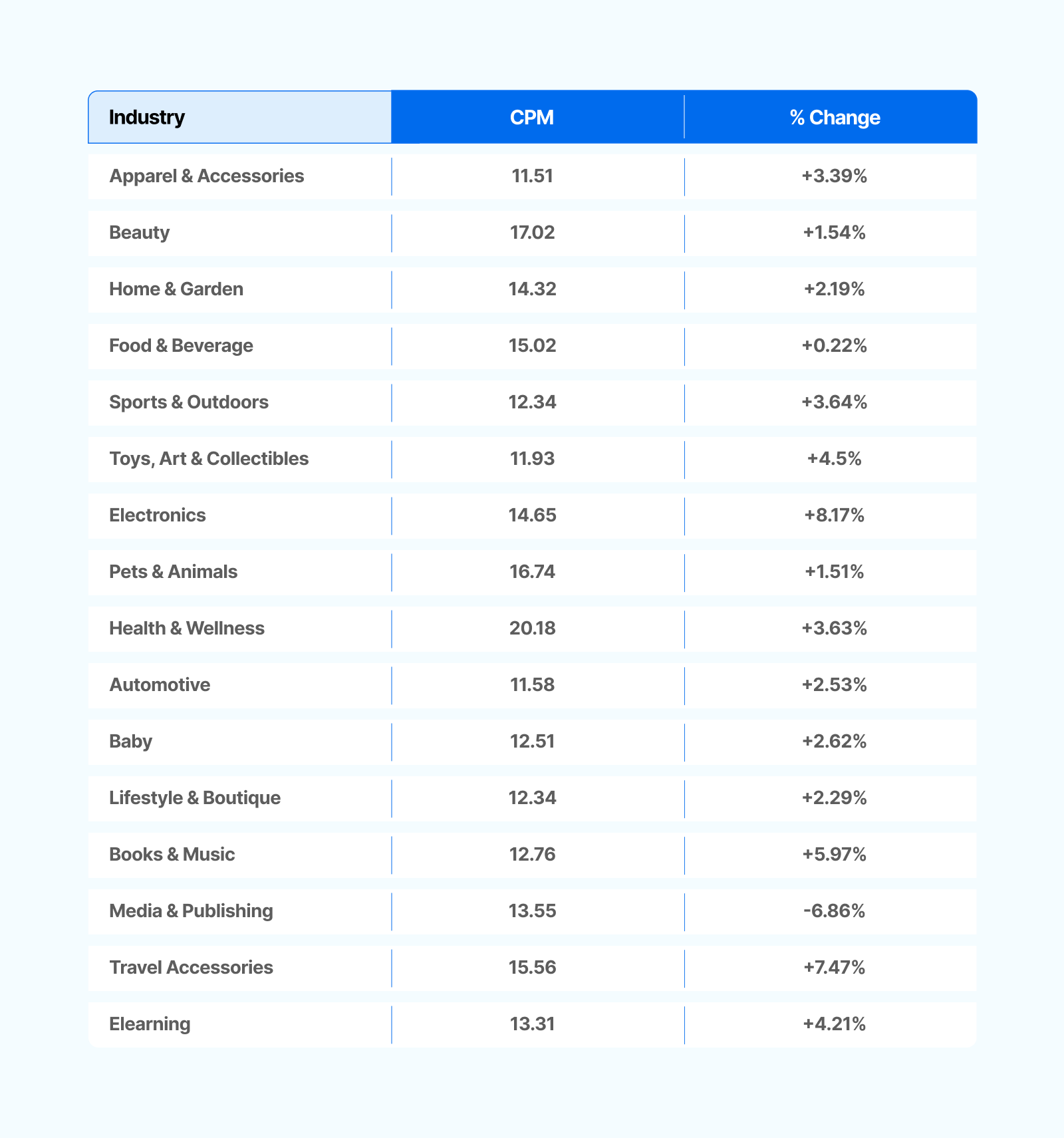

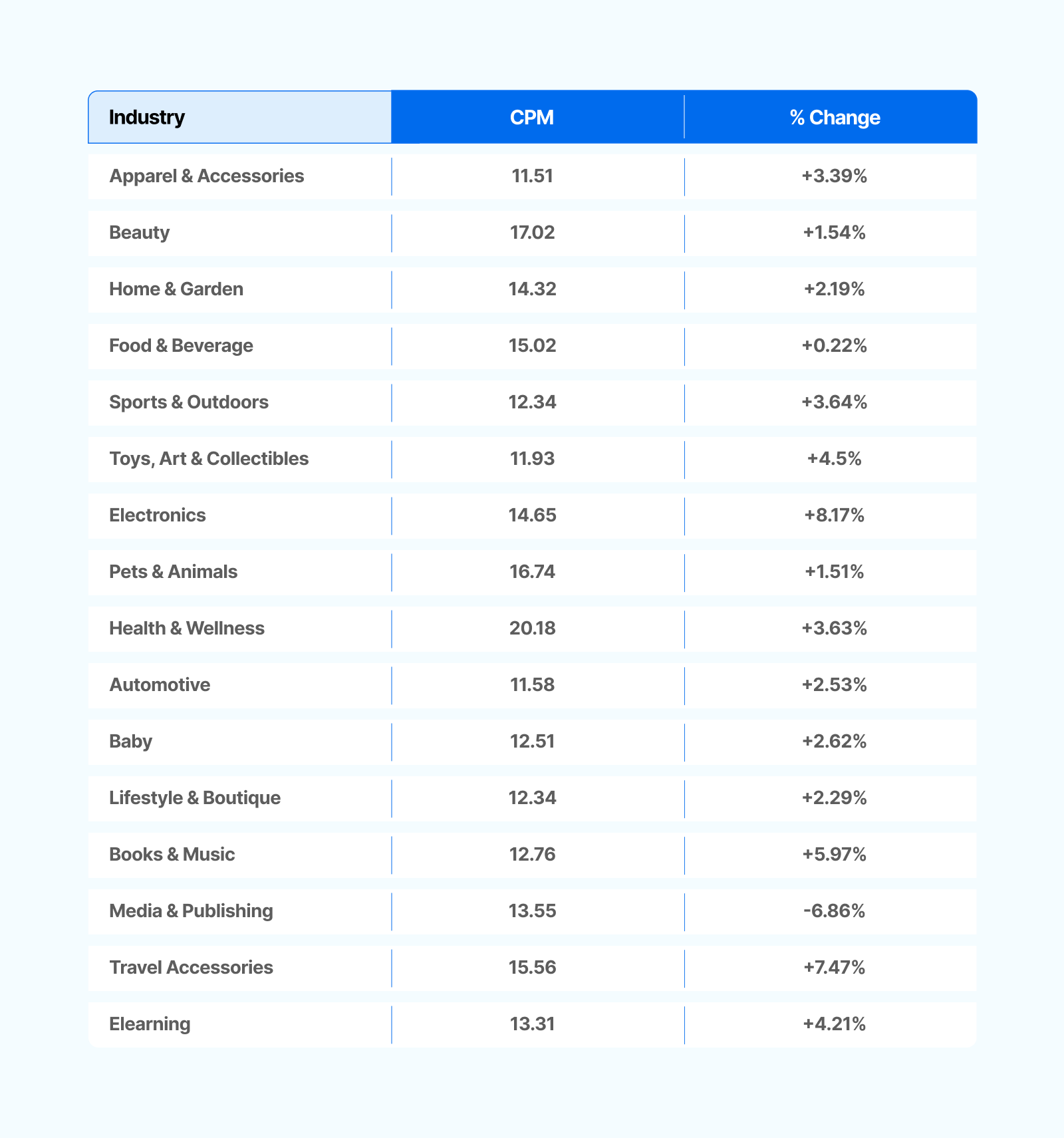

CPM measures the cost per 1,000 ad impressions, a proxy for advertising demand and auction competition. CPMs rose modestly across most sectors in October, reflecting heightened competition ahead of the holiday season.

Electronics (+8.17%) and Travel Accessories (+7.47%) experienced the steepest increases, indicating intensified bidding as brands sought visibility before peak shopping months.

Books & Music (+5.97%) and Toys, Art & Collectibles (+4.5%) also climbed, consistent with early gift-season activity.

Notably, Media & Publishing was the only vertical to see a decline (-6.86%), possibly due to seasonal dips in content promotion.

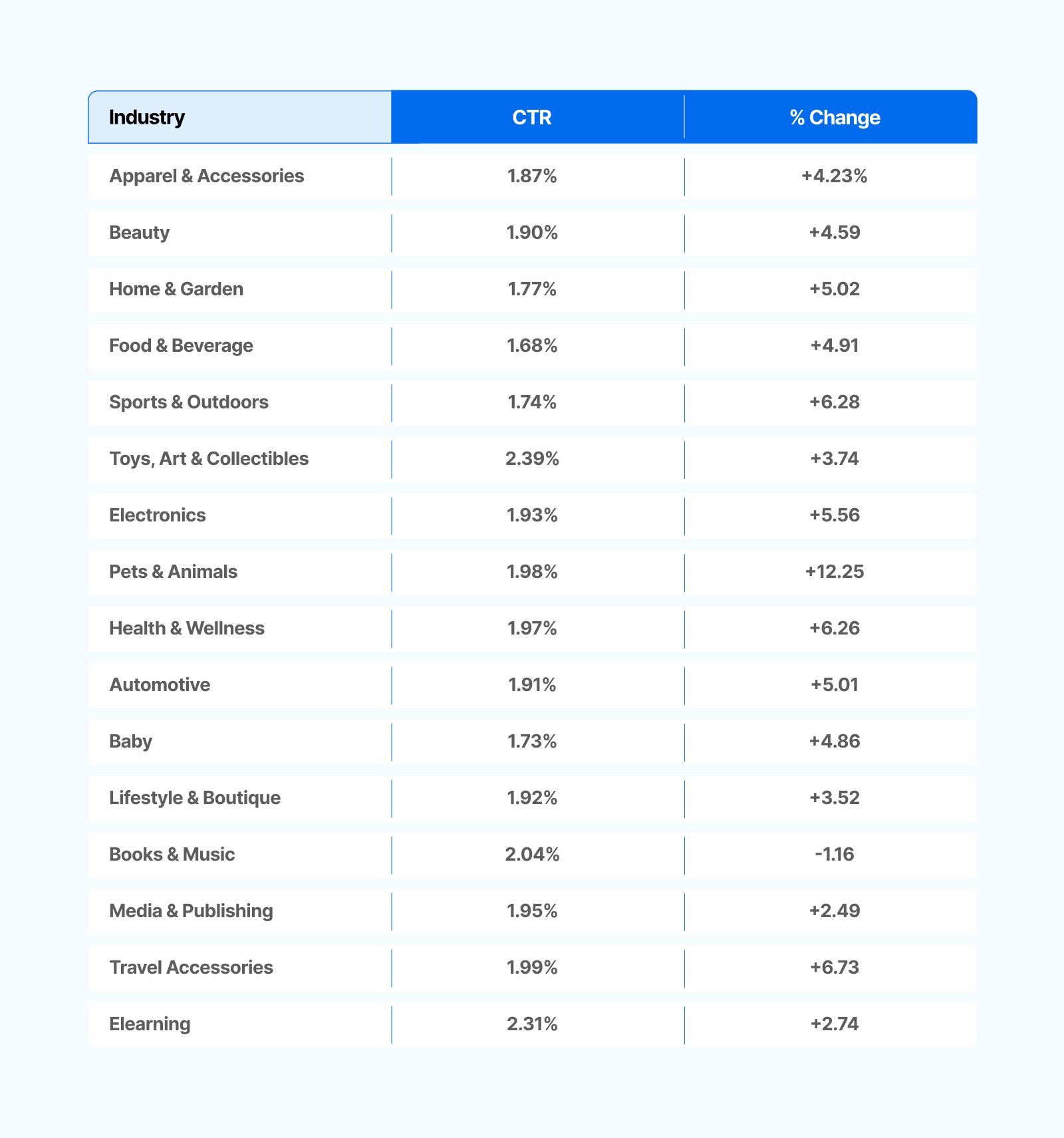

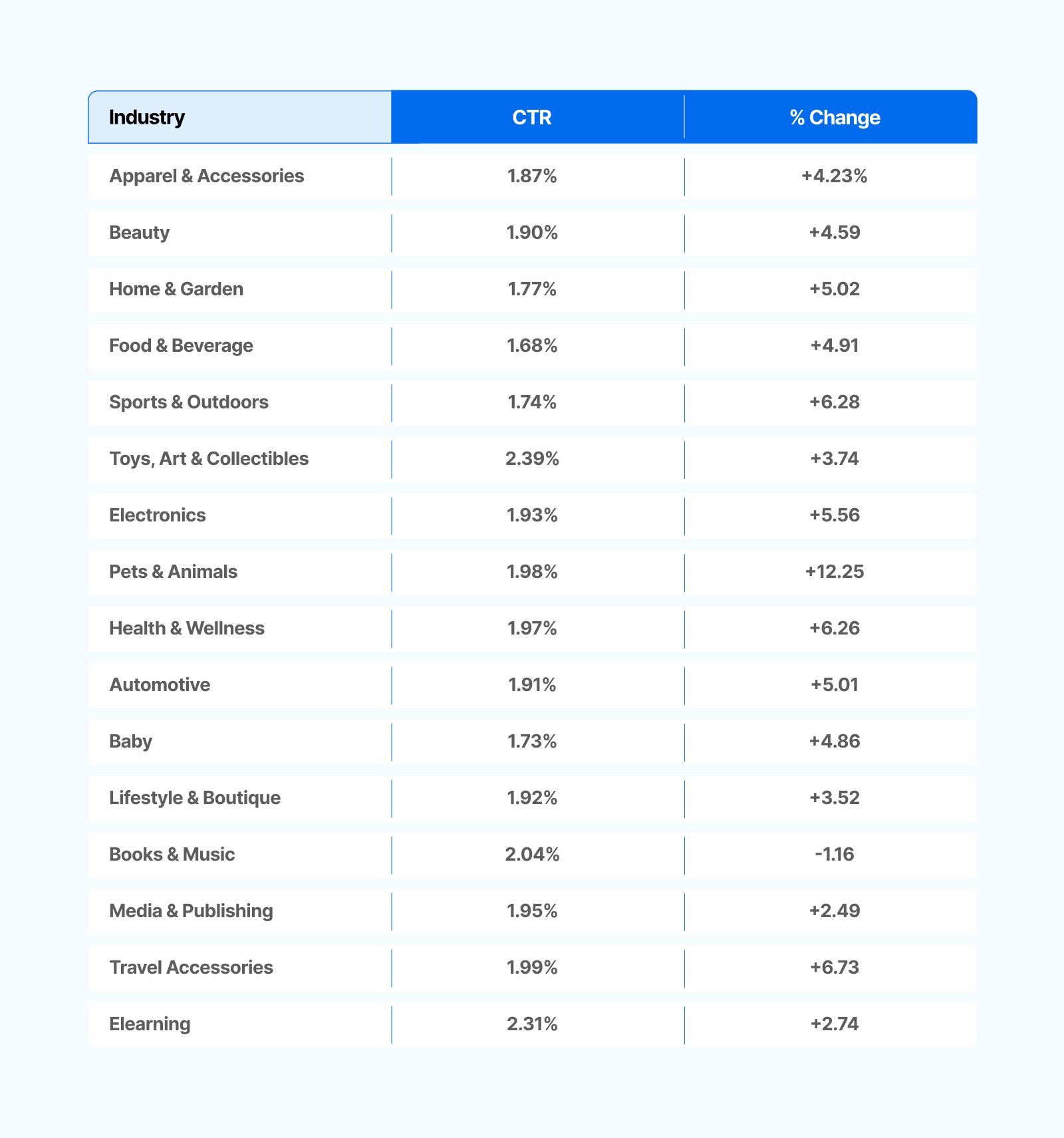

CTR gauges how effectively ads capture audience attention. Electronics saw a standout +12.25% increase, a sign that ad creatives and product messaging resonated strongly during pre-holiday discovery phases.

Travel Accessories (+6.73%), Sports (+6.28%), and Pets (+6.26%) also posted healthy gains. Only Books & Music saw a slight dip (-1.16%), potentially reflecting creative fatigue or less seasonal urgency.

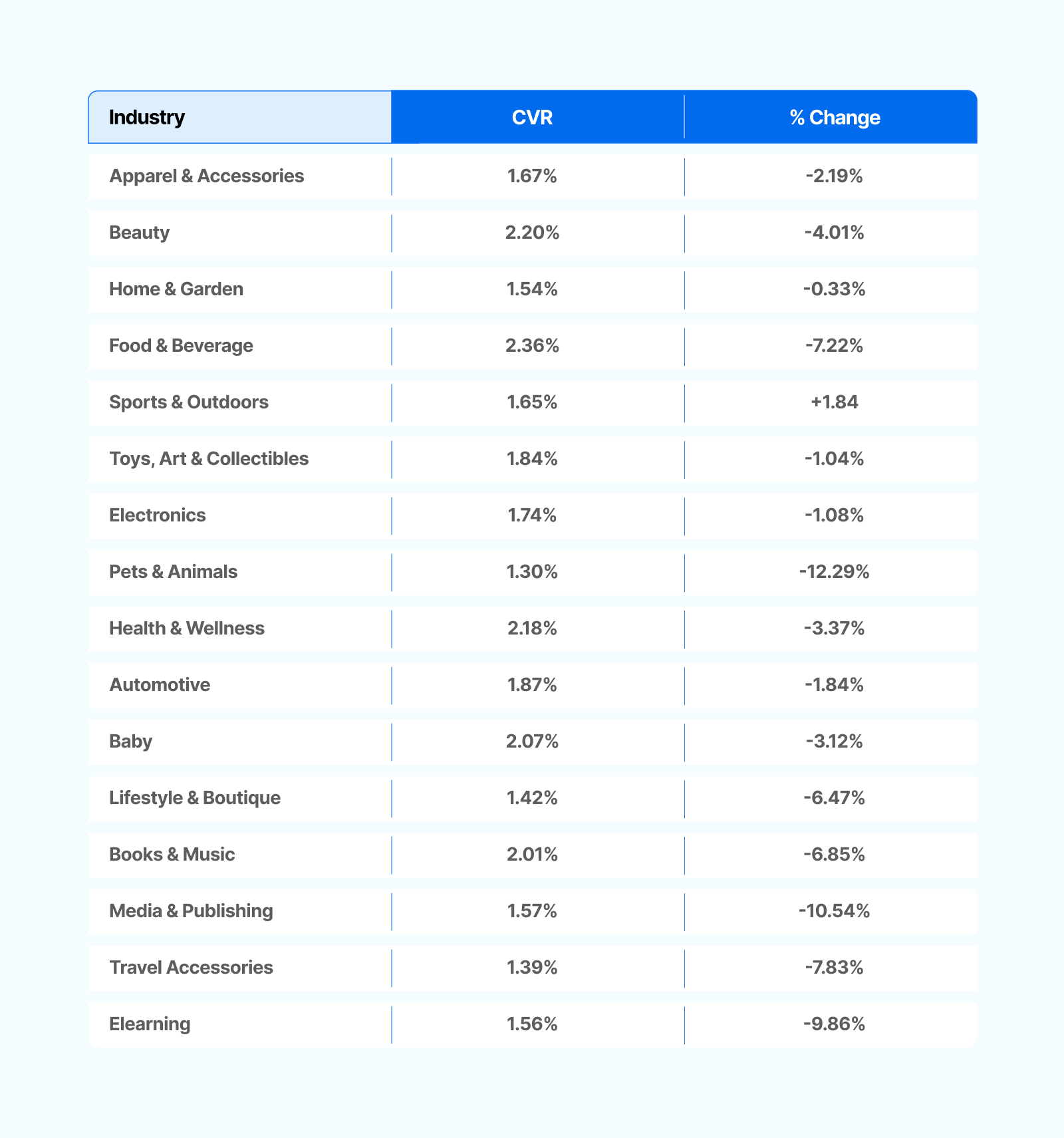

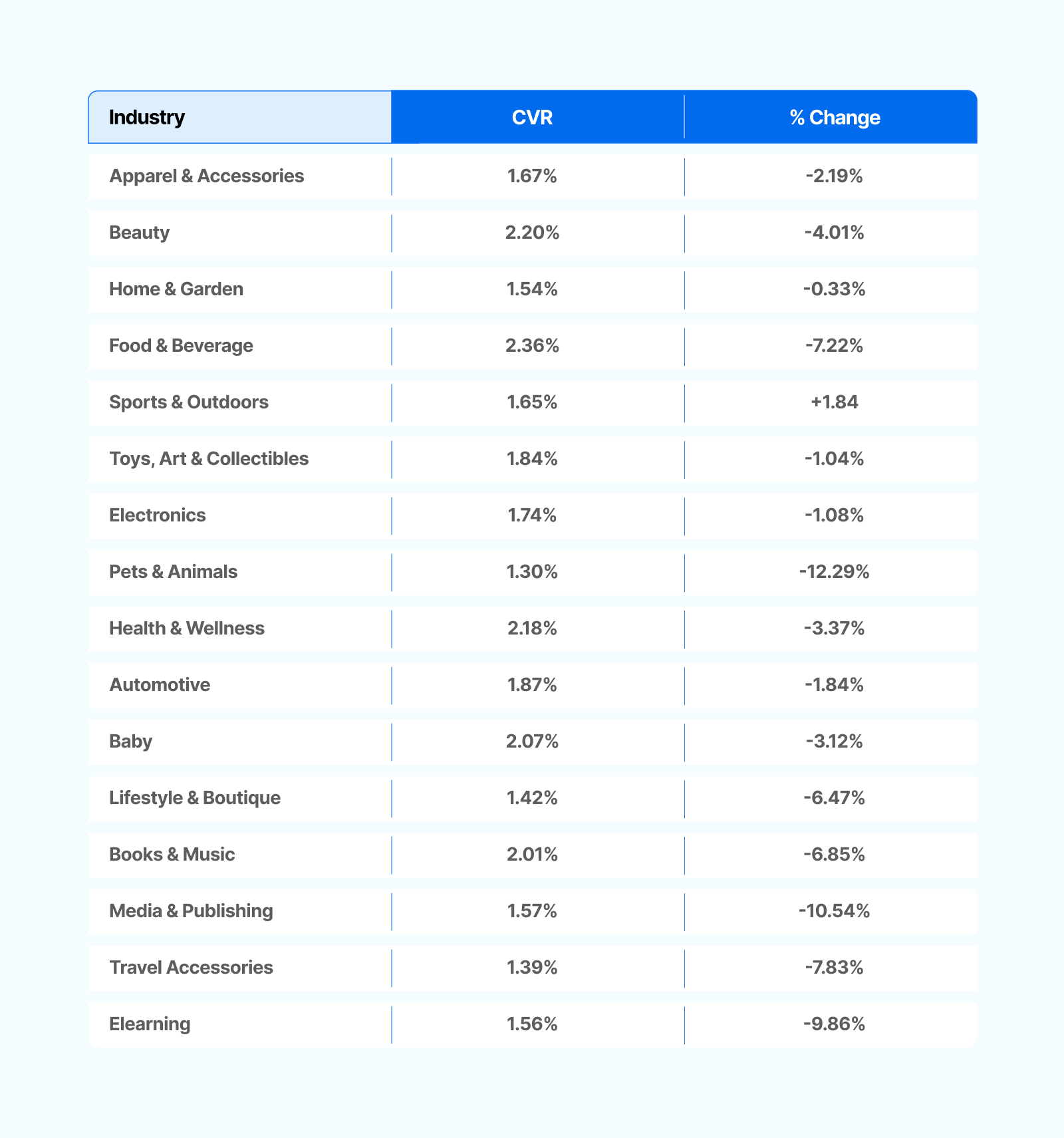

CVR shows the percentage of ad clicks that lead to a purchase and indicates how effectively your marketing drives conversions. Conversion rates softened across most verticals, signaling that while engagement improved, shoppers were slower to commit.

Electronics (-12.29%), Media & Publishing (-10.54%), and Elearning (-9.86%) posted the steepest declines, reflecting consideration-heavy buying cycles or increased browsing behavior before major sales events.

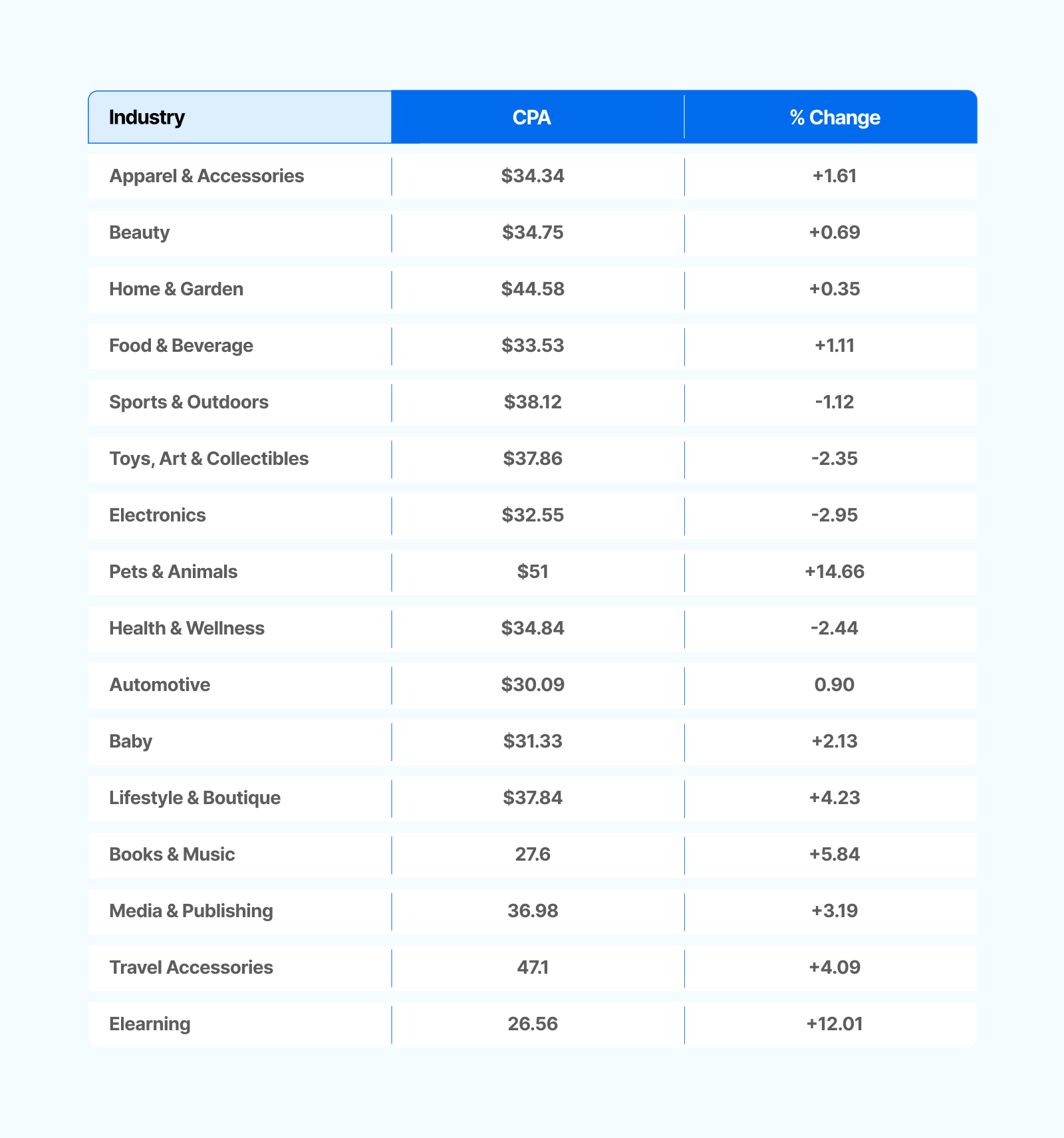

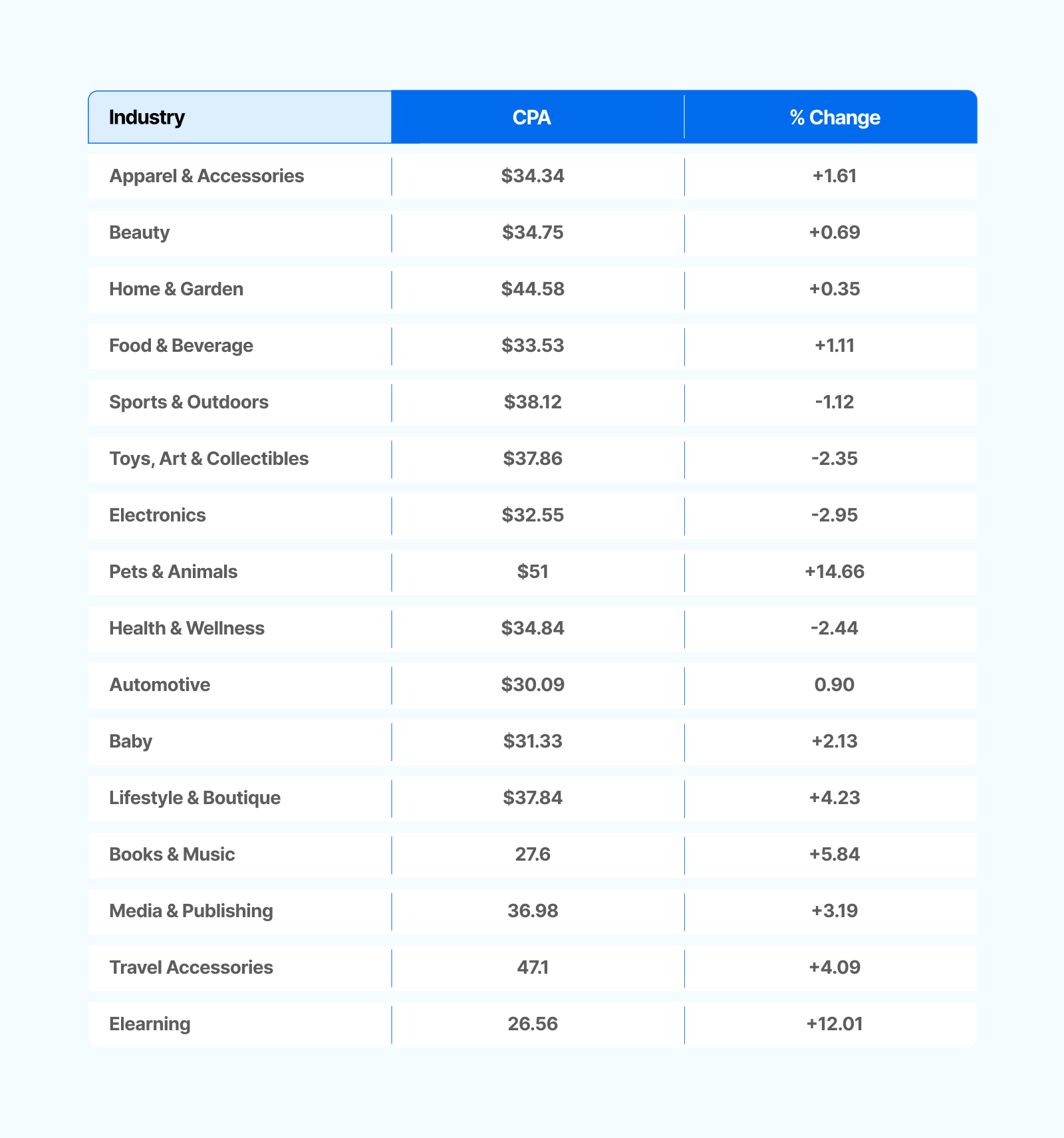

CPA shows how much it costs to acquire a customer. Most industries kept acquisition costs in check despite softer conversions and increased seasonal competition.

Electronics (+14.66%) saw the biggest jump, driven by higher click costs and weaker conversion rates. Elearning (+12.01%) and Books & Music (+5.84%) also faced higher CPAs, suggesting less efficient targeting or creative fatigue.

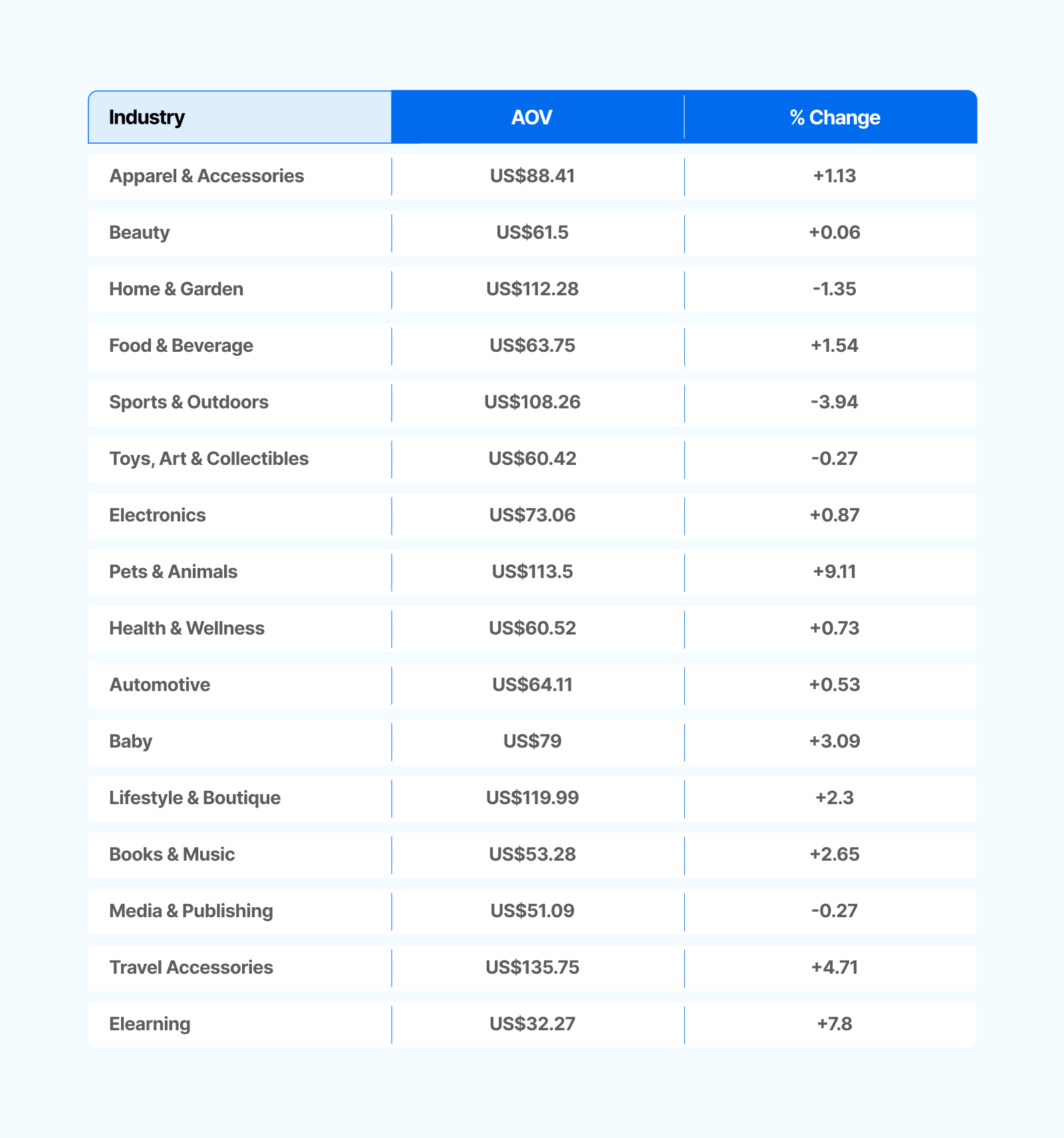

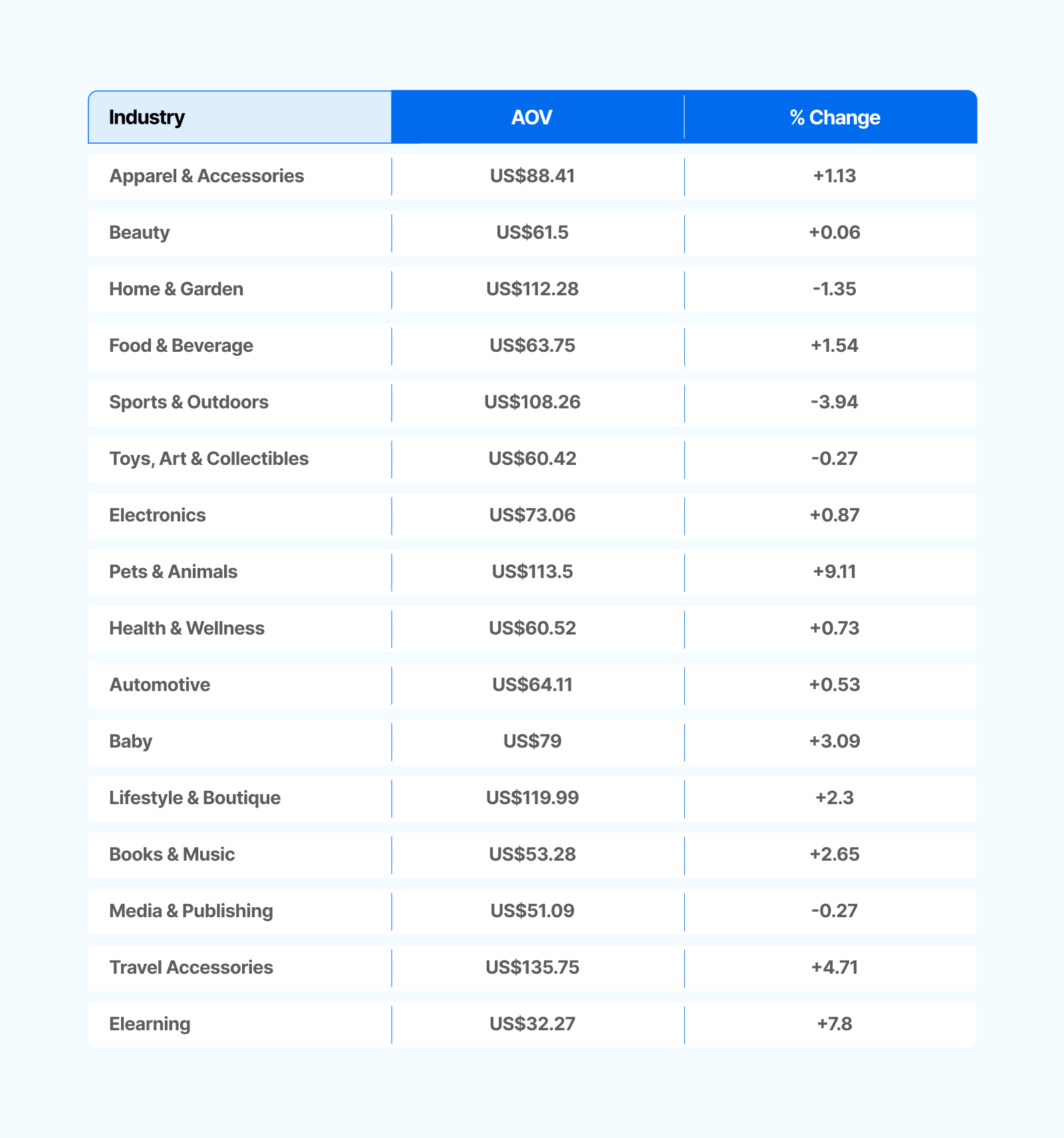

AOV tracks the average transaction value — higher figures can cushion efficiency losses by driving more revenue per order. October AOVs largely held steady, with select verticals seeing meaningful lifts.

Electronics (+9.11%) and Elearning (+7.8%) led the way, showing consumers’ willingness to invest in higher-ticket products and services ahead of Q4 promotions.

Sports (-3.94%) and Home & Garden (-1.35%) slipped slightly, likely due to seasonal category slowdowns.

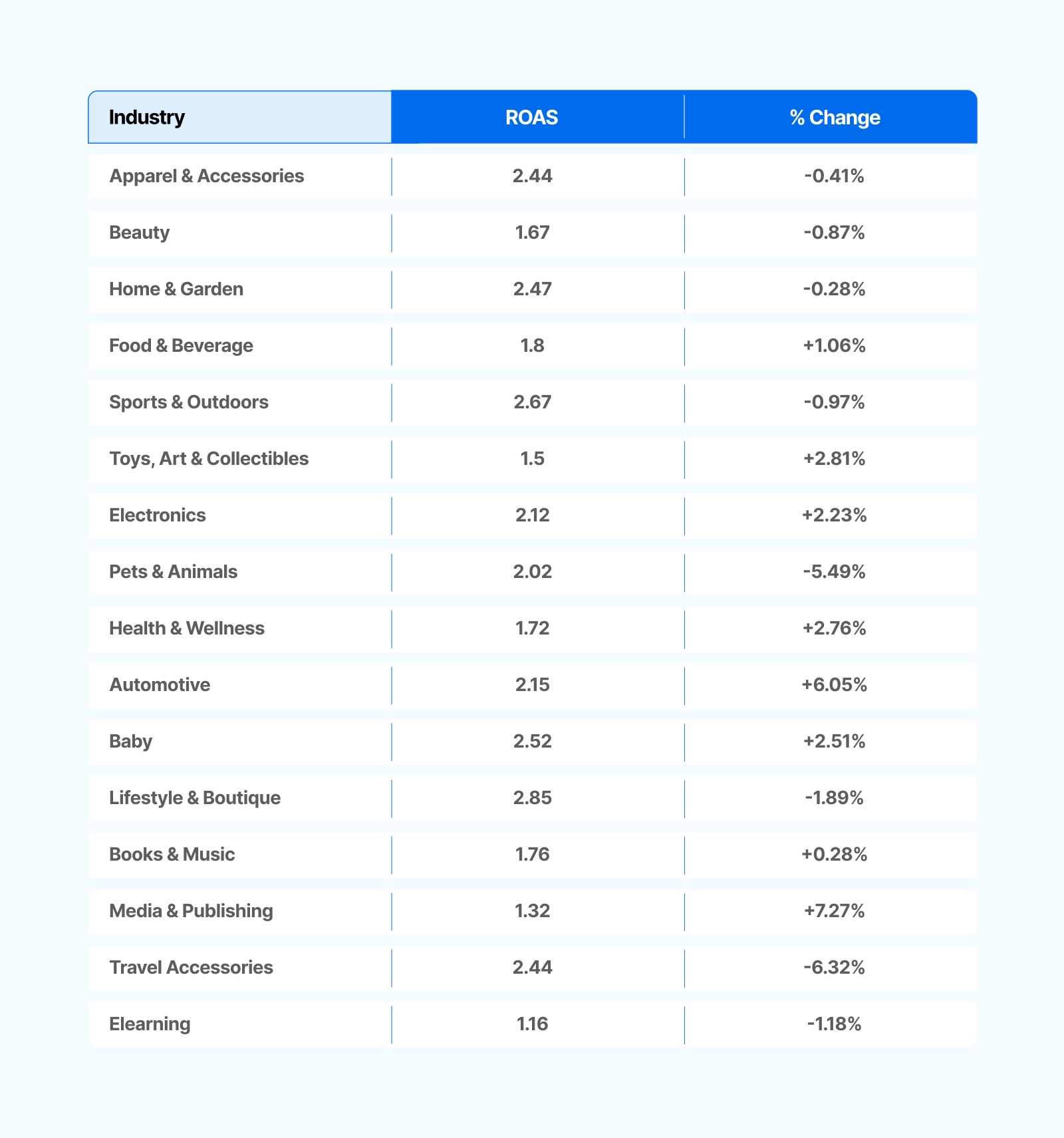

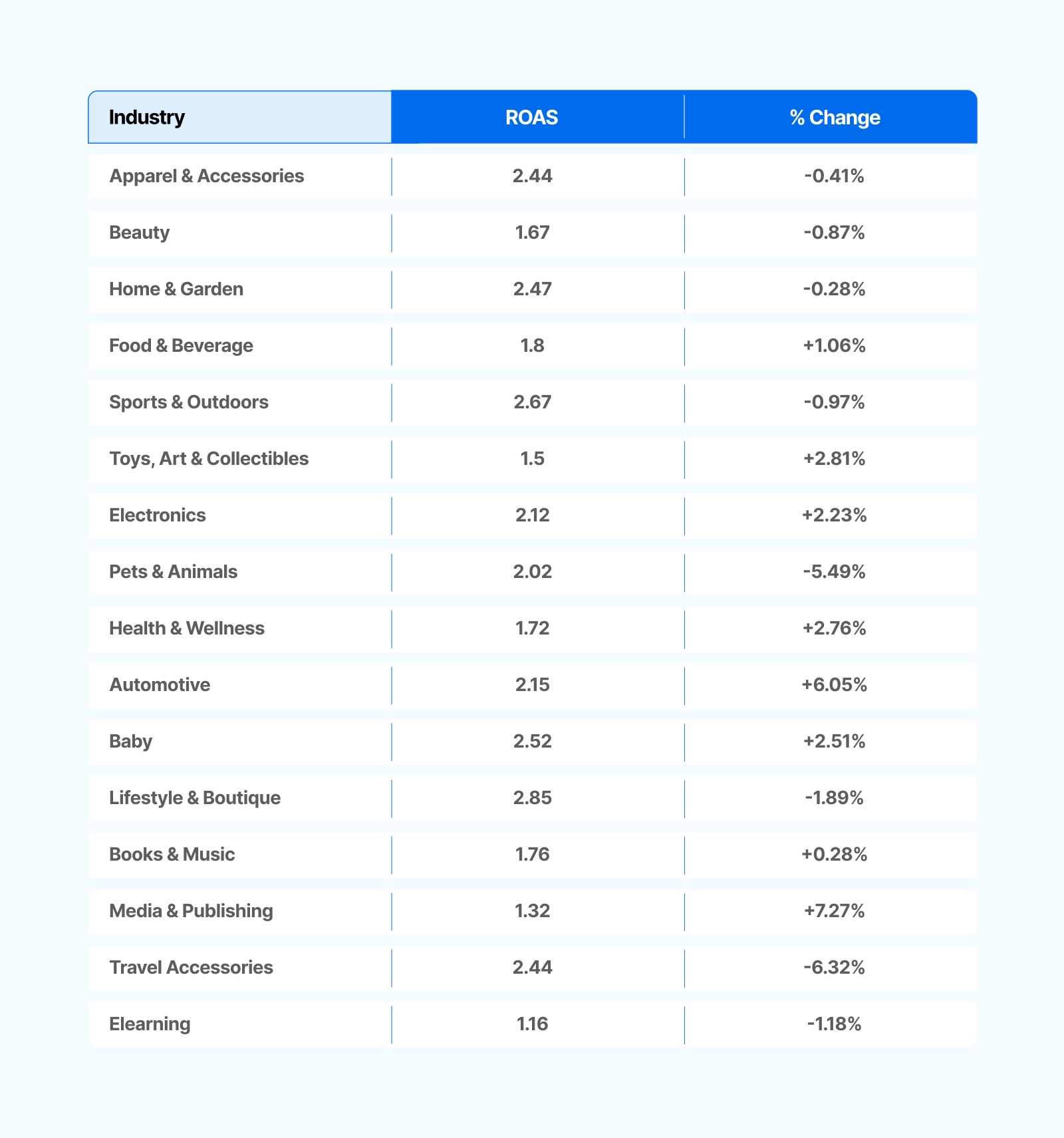

ROAS measures how much revenue is generated per dollar spent on advertising — a direct reflection of overall performance efficiency.

ROAS outcomes were largely steady month-over-month, with a few sectors standing out. Media & Publishing (+7.27%) rebounded sharply, possibly from efficient retargeting or increased subscription revenue.

Lifestyle (+6.05%), Baby (+2.51%), and Pets (+2.76%) also saw meaningful gains, highlighting resilient demand and efficient campaigns.

In contrast, Travel Accessories (-6.32%) and Electronics (-5.49%) experienced notable declines, mirroring their rising CPAs and softening CVRs.

Overall, October’s data indicates a stable but competitive environment. Advertisers spent more and gained broader reach, yet conversion efficiency softened slightly, keeping ROAS largely level.

These Google benchmarks provide a crucial reference for brands to optimize their ad strategies to ensure they maximize returns during the peak spending period upon us.

Get more free ecommerce benchmarks just like this! Check out Trends by Triple Whale.

Our benchmarks report will review common ad performance metrics for Google Ads across brands using Triple Whale to monitor and maximize their performance. This analysis includes over 10,000 brands and compares the period of October 2025 (10/01/2025-10/31/2025) with September 2025 (09/01/2025-09/30/2025).

READ MORE | A Guide to Ecommerce Metrics

Additionally, we’ll break down the vertical-specific trends with data from the following industries:

October 2025 data reveals a steady and balanced month for Google Ads performance. The ecosystem continues to show signs of health and stability — advertisers are spending more, reaching more users, and maintaining efficiency despite slight shifts in conversion dynamics.

The slight overall lift in total ad share to 23.12% (+0.49%) points to a stable ecosystem where spending growth is matched by expanding reach and continued audience responsiveness.

Efficiency metrics painted a more nuanced story. The median CPA rose slightly to $30.34 (+1.94%), indicating marginally higher acquisition costs. However, this modest uptick was offset by stable performance elsewhere. The median CVR dipped 2.08% to 2.78%,

Median ROAS decreased 0.89% to 2.95. The median AOV increased 0.9% to $86.11, and the median MER held steady at 0.31.

Engagement trends remained encouraging: the median CTR climbed 3.7% to 1.56%, implying that ad relevance and targeting continued to improve even as CPMs rose slightly (+2.91%, $14.29).

October brought mixed results across industries. Some categories surged ahead with stronger engagement and higher order values, while others felt early Q4 competition tightened margins. Here’s where performance heated up and where brands may need to recalibrate.

MER reflects how efficiently brands turn ad spend into revenue. This month, Pets & Animals led with a sharp +9.04% increase, reflecting improved profitability, likely driven by loyal repeat purchasers and rising average order values.

Lifestyle & Boutique and Travel Accessories also saw solid gains (+5.52% and +5.18%, respectively), signaling strength in discretionary spending as consumers prepared for holiday travel and gifting.

On the downside, Media & Publishing (-6.67%) and Automotive (-4.01%) faced steeper drops, suggesting less conversion traction amid rising competition and ad costs.

CPM measures the cost per 1,000 ad impressions, a proxy for advertising demand and auction competition. CPMs rose modestly across most sectors in October, reflecting heightened competition ahead of the holiday season.

Electronics (+8.17%) and Travel Accessories (+7.47%) experienced the steepest increases, indicating intensified bidding as brands sought visibility before peak shopping months.

Books & Music (+5.97%) and Toys, Art & Collectibles (+4.5%) also climbed, consistent with early gift-season activity.

Notably, Media & Publishing was the only vertical to see a decline (-6.86%), possibly due to seasonal dips in content promotion.

CTR gauges how effectively ads capture audience attention. Electronics saw a standout +12.25% increase, a sign that ad creatives and product messaging resonated strongly during pre-holiday discovery phases.

Travel Accessories (+6.73%), Sports (+6.28%), and Pets (+6.26%) also posted healthy gains. Only Books & Music saw a slight dip (-1.16%), potentially reflecting creative fatigue or less seasonal urgency.

CVR shows the percentage of ad clicks that lead to a purchase and indicates how effectively your marketing drives conversions. Conversion rates softened across most verticals, signaling that while engagement improved, shoppers were slower to commit.

Electronics (-12.29%), Media & Publishing (-10.54%), and Elearning (-9.86%) posted the steepest declines, reflecting consideration-heavy buying cycles or increased browsing behavior before major sales events.

CPA shows how much it costs to acquire a customer. Most industries kept acquisition costs in check despite softer conversions and increased seasonal competition.

Electronics (+14.66%) saw the biggest jump, driven by higher click costs and weaker conversion rates. Elearning (+12.01%) and Books & Music (+5.84%) also faced higher CPAs, suggesting less efficient targeting or creative fatigue.

AOV tracks the average transaction value — higher figures can cushion efficiency losses by driving more revenue per order. October AOVs largely held steady, with select verticals seeing meaningful lifts.

Electronics (+9.11%) and Elearning (+7.8%) led the way, showing consumers’ willingness to invest in higher-ticket products and services ahead of Q4 promotions.

Sports (-3.94%) and Home & Garden (-1.35%) slipped slightly, likely due to seasonal category slowdowns.

ROAS measures how much revenue is generated per dollar spent on advertising — a direct reflection of overall performance efficiency.

ROAS outcomes were largely steady month-over-month, with a few sectors standing out. Media & Publishing (+7.27%) rebounded sharply, possibly from efficient retargeting or increased subscription revenue.

Lifestyle (+6.05%), Baby (+2.51%), and Pets (+2.76%) also saw meaningful gains, highlighting resilient demand and efficient campaigns.

In contrast, Travel Accessories (-6.32%) and Electronics (-5.49%) experienced notable declines, mirroring their rising CPAs and softening CVRs.

Overall, October’s data indicates a stable but competitive environment. Advertisers spent more and gained broader reach, yet conversion efficiency softened slightly, keeping ROAS largely level.

These Google benchmarks provide a crucial reference for brands to optimize their ad strategies to ensure they maximize returns during the peak spending period upon us.

Get more free ecommerce benchmarks just like this! Check out Trends by Triple Whale.

Body Copy: The following benchmarks compare advertising metrics from April 1-17 to the previous period. Considering President Trump first unveiled his tariffs on April 2, the timing corresponds with potential changes in advertising behavior among ecommerce brands (though it isn’t necessarily correlated).